Table Of Content

Your money is, for the most part, locked up and not fully spendable until you sell the home. However, there are ways to access some of your equity and convert it into cash while you still own the home. Like a cash-out refinance, a home equity loan is a secured loan that uses your home equity as collateral. This gives you access to lower interest rates than unsecured loans, like personal loans. The good news is that as the equity in your property builds, you might be able to remortgage at a lower LTV. In turn, this could mean lower interest rates and monthly repayments.

Alternative Financing Options To Buy Another House

However, they will be factors regardless of which option you choose. These choices usually match with the situations and goals listed below. A portion of each mortgage payment you make will go toward the principal balance of your home loan. The rest will usually go toward paying interest, property taxes and homeowners insurance. As you pay down your mortgage, the amount of equity in your home will rise.

How to Borrow Against Home Equity

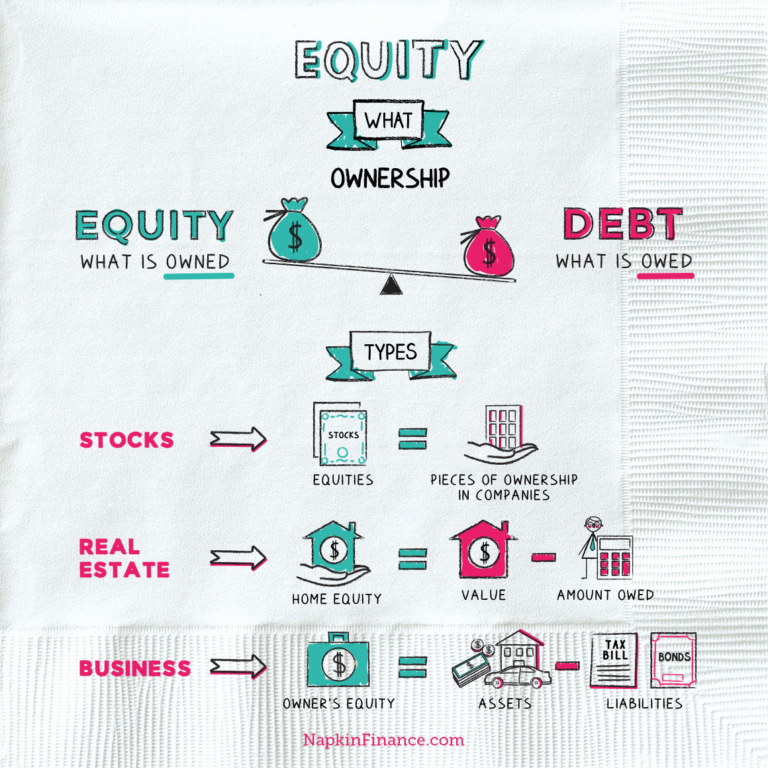

Homeownership is one of the most straightforward paths to building wealth. The key component is growing your equity, which gradually shifts your debt into an asset. You can use your home equity and the funds you borrow to your financial benefit. Another way equity can grow is from the appreciation of your property's value. You can also lose equity if you take out a second mortgage using your equity as collateral.

Example of a Home Equity Loan

It doesn’t replace your current mortgage; it’s a second mortgage that requires a separate payment. For this reason, home equity loans tend to have higher interest rates than first mortgages. Though you no longer need a 20% down payment to buy a home with a conventional loan, most lenders require you to purchase private mortgage insurance (PMI) if you don’t put at least 20% down. Even though the borrower pays for it, PMI only protects the lender. If you want to build equity faster in the first few years of your mortgage, you can pay more than your minimum monthly payment.

California Gov. Gavin Newsom has approved two measures to slice through local zoning ordinances as the most populous state struggles with an affordable housing shortage. California’s urban areas must become more densely populated if we’re to provide enough affordable housing for 40 million-plus people. If the average annual increase were 2%, you would still have $48,773 equity in your home. Let’s say you buy a home for $250,000, and its value appreciates by 3.5% per year, on average.

Home improvements can add value to your home and increase equity

A home equity line of credit, or HELOC, is a type of second mortgage that lets you borrow against your home equity. Somewhat like with a credit card, you use money from the HELOC as needed and then pay it back over time. You can access it via online transfer or with a bank card at an ATM or point of sale (the same as you would with a debit card), or you can write checks from the account if the lender issues them. Shop around with at least three lenders when looking for the best HELOC rate. Check your bank or mortgage provider; it might offer discounts to existing customers.

Pay for college

Specifically, equity is the difference between what your home is worth and what you owe your lender. As you make payments on your mortgage, you reduce your principal – the balance of your loan – and you build equity. Once you have enough equity built up, you can access it by taking out a home equity loan, home equity line of credit (HELOC) or by using a cash-out refinance. Your usual mortgage payments will reduce what you owe and so should steadily increase your equity.

Advantages and Disadvantages of a Home Equity Loan

However, always remember that you’re putting your home on the line—if real estate values decrease, you could end up owing more than your home is worth. If you have $40,000 in equity, you might qualify for a HELOC with a maximum spending limit of $30,000. This means you can borrow up to $30,000 during the draw period – but no more.

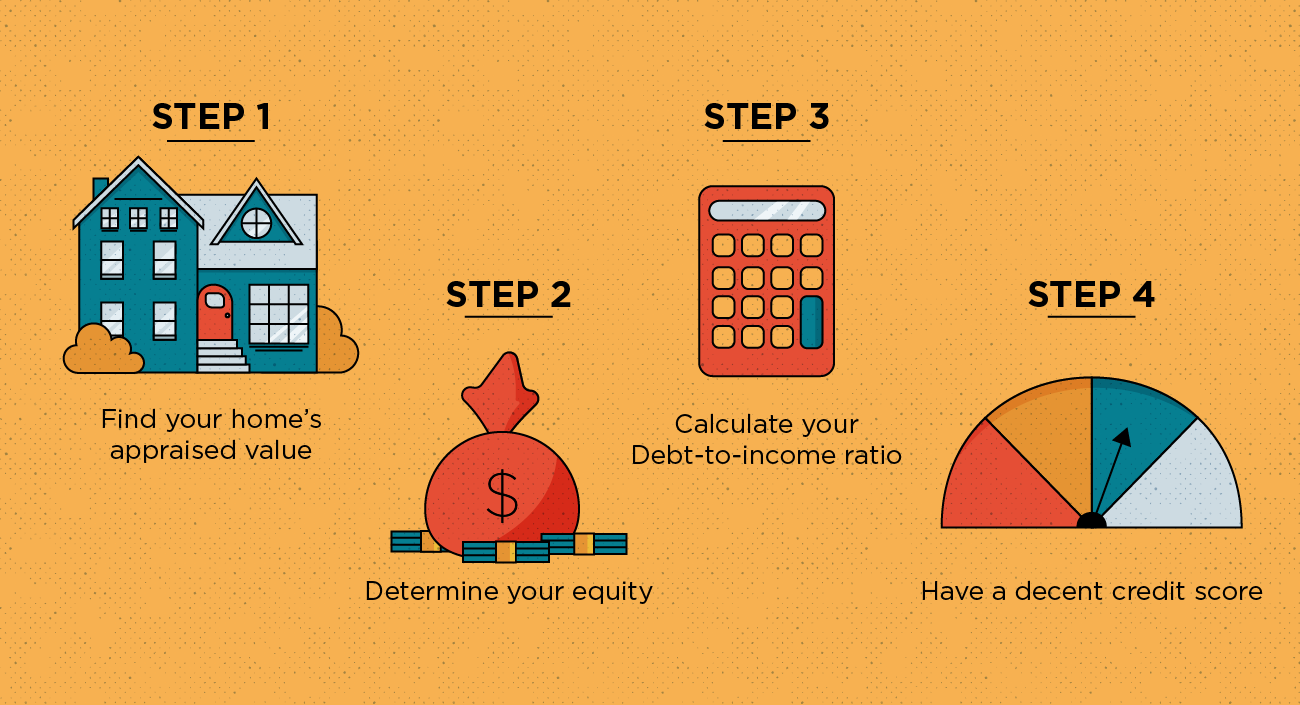

If you needed another mortgage for short-term projects like remodeling a few rooms in your house and replacing light fixtures, you could try to apply for a five-year loan. For a conventional loan, the most popular type of mortgage, you'll need a minimum credit score of 620. The purchase price of the home doesn't typically have a direct impact on what credit score you'll need. However, if a higher price leads to you making a small down payment, you may need to have a better score to compensate for that. Ideally, you'll want to have a credit score of 740 or better if you're getting ready to buy a house, since this will help you get a good mortgage rate.

If you still owe money on your mortgage, you only own the percentage of your home that you’ve paid off. If you find yourself in negative equity, you may struggle to move or remortgage when the initial deal on your mortgage runs out. Waiting for house prices to increase, making home improvements and overpaying on your mortgage might all help you to escape negative equity. Carrying out certain home improvements has the potential to increase the value of your property, and so could also accelerate the rate at which you build equity in your home. These could range from something relatively simple like redecorating to more extensive work, such as fitting a new kitchen or bathroom, building an extension or converting the loft.

Once you know how much you’ll need, you’ll want to calculate the value of your equity relative to the value of the home. Many lenders will require you to have at least 20% equity in your home, though some will allow you to borrow over 90% of the value of your home. First-time home buyers may have to choose from a smaller pool of lenders with higher combined loan-to-value — or CLTV — limits, having made an average down payment of 6%. If the market happens to cool by the time you choose to sell, you may want to hang tight if possible until the market favors sellers and the value of your home increases. A HELOC works similarly to a home equity loan, with a few key differences.

Typically, home appraisals cost between $300 and $400 for a single-family home—but this depends on the property’s size, condition and value. Using a home equity loan for debt consolidation can help you simplify your payments. Read on to learn more and explore other ways to consolidate your debts. Whether a cash-out refinance or Home Equity Loan makes the most sense for you will depend on a blended rate calculation. Home equity loans make accessing the cash you have tied up in your house easy, but you still need to make sure they’re the right fit for your finances. Here are some other frequently asked questions regarding home equity loans to help you make the right decision.

Best Home Equity Line of Credit (HELOC) Rates for April 2024 - CNET

Best Home Equity Line of Credit (HELOC) Rates for April 2024.

Posted: Wed, 24 Apr 2024 07:00:00 GMT [source]

A portion of each payment includes interest and an amount that reduces the outstanding principal that you still owe. Home equity is the difference between the amount you owe on a mortgage and what the home is worth. The amount of equity in a house can grow over time as you make payments and the property's value increases.

No comments:

Post a Comment