Table Of Content

- Should I choose a home equity loan, HELOC, or cash-out refinance?

- Everything You Need To Know About Home Equity Loans For Debt Consolidation

- Learn more about Bloomberg Law or Log In to keep reading:

- Don’t be fooled: California’s new housing laws make significant changes to zoning

- How to Increase Your Home Equity

- Cash-Out Refinance

- How To Get A Home Equity Loan

Your credit score is important because it helps lenders understand your credit history. Individuals with higher credit scores often benefit from lower interest rates. A cash-out refinance replaces your existing mortgage with a brand new, larger loan, allowing you to spend the difference. This means that you’ll have a new interest rate on your primary mortgage, which won’t be ideal if rates have risen since you initially bought your home. When you’re shopping for a home equity loan, it’s smart to make sure your financials are in as good a shape as possible. This means pulling your credit reports from the three main credit reporting agencies — Experian, Equifax and TransUnion — and addressing any errors you find.

Should I choose a home equity loan, HELOC, or cash-out refinance?

But it’s important to be aware that some loans don’t operate this way. If you take out an interest-only or other non-amortizing mortgage, you won’t reduce your principal balance or build equity. Instead, your payments will only go toward your interest, property taxes and insurance. Eventually, you’ll need to pay a lump sum to pay off your loan principal balance.

Everything You Need To Know About Home Equity Loans For Debt Consolidation

How to Calculate Home Equity - Bankrate.com

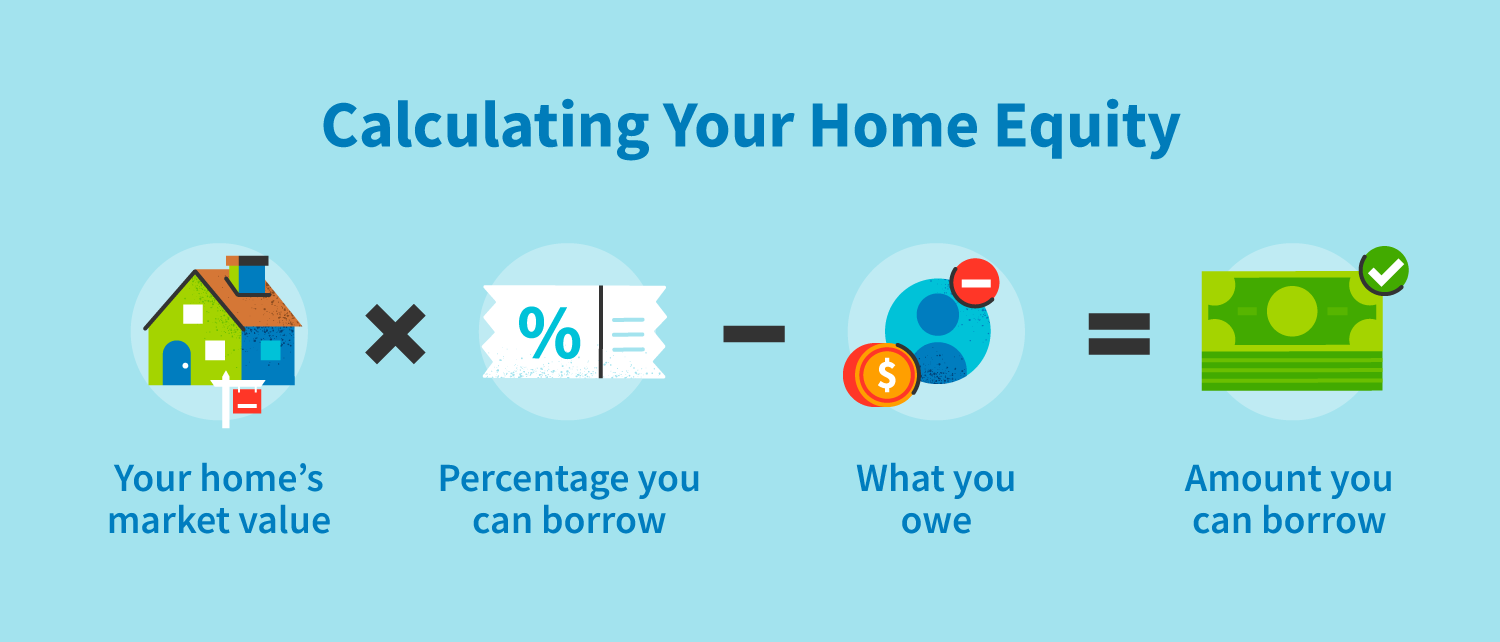

How to Calculate Home Equity.

Posted: Mon, 01 Apr 2024 07:00:00 GMT [source]

Rocket Mortgage doesn’t charge prepayment penalties, but some lenders do. Check with your lender before you start making extra payments on your mortgage. Even though home equity loans have lower interest rates, your term on the new loan could be longer than that of your existing debts. A home equity loan—also known as an equity loan, home equity installment loan, or second mortgage—is a type of consumer debt.

Learn more about Bloomberg Law or Log In to keep reading:

Your home is likely to be one of the most valuable assets you will own. Additionally, each lender has its own eligibility criteria when it comes to getting approved for a home equity loan and a mortgage on the second home, if needed. For example, some lenders might not be willing to approve you if you’re using a home equity loan to cover your down payment.

Using a Home Equity Loan To Buy an Investment Property

Census Bureau’s 2021 American Housing Survey report shows that the average project (or series of projects) financed by a home equity loan cost $11,240. The report also shows that the kitchen tends to be the most expensive room to renovate, with homeowners spending a median amount of $35,000. Steadily paying down your mortgage is one way to grow your home equity. If real estate values have risen in your area since you purchased your home, your equity may be growing even faster. Since your home is the collateral for an equity loan, failure to repay could put you at risk of foreclosure.

Don’t be fooled: California’s new housing laws make significant changes to zoning

Typically, the lender will sell the house as quickly as possible to try to recoup as much money as they can. While home values tend to rise over time, home appreciation is not guaranteed. The value of your home may fall in any given period — called depreciation. If you’re underwater, or upside down, on your mortgage, that means you owe more on your home than it’s worth. Getting back right side up on your home takes hard work, but you'll keep your home and the equity you've built.

How to Increase Your Home Equity

Before you decide to get a home equity loan, you should be aware of the pros and cons. Consider your financial circumstances to determine whether the advantages outweigh the disadvantages. A home equity loan is best used for a repair, renovation or project that will add to the value of the home.

Fortunately, you have a couple of options when it comes to finding an exit route. You may be able to buy a house using an FHA loan if you have a 600 credit score. Ultimately, there is no singular credit score that can guarantee you a mortgage approval. If you have a strong credit score, you'll have a better chance of securing a good mortgage rate. A lender may do this as part of an introductory offer to attract borrowers before switching to a positive margin later in the life of the loan.

How To Get A Home Equity Loan

To maintain our free service for consumers, LendEDU sometimes receives compensation when readers click to, apply for, or purchase products featured on the site. Compensation may impact where & how companies appear on the site. Additionally, our editors do not always review every single company in every industry.

The bigger your down payment, the more equity you’ll immediately have in your home. Your home is not only where you live, but it might be your biggest financial asset. Before you tap into home equity for any reason, carefully evaluate the risk.

You will repay the $220,000 total in monthly payments with interest. How much extra you can include in your cash-out refinance depends on the equity in your home. You can elect to receive your proceeds in one lump sum, regular monthly payments or as a line of credit. And you won’t pay back your loan unless you sell your home, move out for more than 6 months out of a year or pass away. If you sell the property, you can use the profits from your home sale to pay back the loan. Because a home equity loan is secured by your house, it’s seen as less risky to the lender—so they tend to offer a lower interest rate compared to other types of loans.

The next number you’ll need is the outstanding balance on your mortgage, which can be found on your most recent statement. You could also check your lender or servicer’s online dashboard, assuming it has one, or call directly for this information. To increase your property’s value, you can invest in remodeling and home improvement projects.

What is a Home Equity Agreement and How Does It Work? (2024 Guide) - MarketWatch

What is a Home Equity Agreement and How Does It Work? (2024 Guide).

Posted: Wed, 24 Apr 2024 07:00:00 GMT [source]

There’s no monthly mortgage payment with a reverse mortgage, though you must still pay taxes and insurance. Every time you make a mortgage payment, you gain a little more equity in your home. At the very beginning of your mortgage repayment, you gain equity slowly because most of the money you pay in the first few years goes toward interest instead of your mortgage’s principal. Also, compared to the rates that are attached to credit cards, your interest rates will likely be lower through a home equity loan.

This also makes them risky, because you can lose your home if you cannot make your payments. Once you've determined the full amount of your equity, you may or may not be able to borrow the full amount. The loan to value (LTV) ratio is your current loan balance divided by the appraised value of your home.

It’s recommended that you reach out to more than one, so that you can find the best available rate and terms. Our list of the top home equity loan lenders can be a great place to start. Another feature of HELOCs is that they typically (though not always) come with a variable interest rate, meaning that the rate will change with the market over time.

And the interest on your loan could be tax deductible if you meet the criteria outlined by the IRS. By getting either type of loan, you’d essentially be taking on a second mortgage. Under the terms of a home equity loan, your lender would convert your equity amount into a lump sum of cash money that you could then use for whatever you’d like. You can calculate by taking the appraised value of your home and subtracting the balance remaining on your mortgage. It matters because you can borrow against this money to improve your home and raise the property value or pay off high-interest debt.

No comments:

Post a Comment